What are IOLTA Prime Partners?

Wisconsin is fortunate to have banks and credit unions that recognize the value in strengthening their communities. WisTAF's Prime Partner program lets financial institutions take a leadership role in investing in justice for all.

Law firms, simply by locating their IOLTA account at a Prime Partner, are working to increase access to justice in Wisconsin.

List of Prime Partners

A list of all IOLTA Prime Partner financial institutions is at the top of our IOLTA Participating Financial Institutions page.

How it works

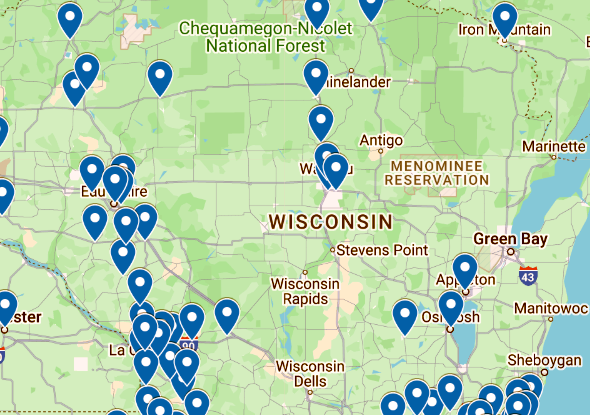

Locations of the IOLTA Prime Partner branches are shown on our map.

Prime Partners go above and beyond: paying interest rates on IOLTA accounts at least 50 basis points (0.50 percent) higher than required under the Wisconsin Supreme Court’s IOLTA interest rate comparability requirement.

In return for this service, Prime Partners receive special recognition and perks from WisTAF.

Why it matters

Prime Partners' additional support lets more people with low incomes, in more Wisconsin communities, obtain fair legal outcomes in civil matters.

What you can do

Want to take your business to a Prime Partner? Find them on this map of their branch locations, or get their names from the list of all IOLTA Participating Financial Institutions.

Financial institutions can explore becoming a Prime Partner here.

Staff listing | service@wistaf.org

203 S. Paterson St., Ste. 200

Madison, WI 53703

608-257-6845 or 877-749-5045 (toll-free)

Disclaimer of liability | Terms & conditions of use

| Privacy statement | Financial institution login

Web services by FotoPlant llc.